iProperty.com will be holding its annual International Property and Investment EXPO on the 16th and 17th of May at the Suntec Convention and Exhibition Centre, Hall 403, from 10 am to 8 pm. The EXPO will showcase developments from Australia, Indonesia, Japan, Malaysia, Thailand and the UK, as well as a variety of investment seminars. The event's Seminar Speaker Series will feature insights and tips from industry experts regarding overseas property investment.

For the first time at the EXPO, seminars introducing alternative investments concepts, such as Art Index International, will take place with a range of artwork for investment. The artwork is then rented on an investor's behalf to corporations for display. Potential returns on investment can be as high as 9.5 per cent per annum.

Admission is free to the EXPO. Up to three attendees who pre-register for the event will stand a chance to win an iPad. For more information and to register for the event and seminars, please visit www.iproperty.com.sg or expo.iproperty.com.sg.

New rail terminus to develop the Jurong East area towards becoming an alternative CBD

Jurong East has been selected as the location for the highly anticipated Singapore - Kuala Lumpur High Speed Rail (HSR) terminus. This is another enhancement to the region that has already seen major redevelopment over the past few years including new commercial, leisure and business amenities. The area was chosen over Tuas West and the Singapore city centre due to its transport links as well as its growing potential as a commercial hub.

Analysts who spoke to TODAY had mixed reactions to the decision. Mr Colin Tan, Director of Research and Consultancy at Suntec Real Estate, commented that the area of choice was "ideal" due to its convenient public transport channels, with the neighbouring Lakeside and Chinese Garden being viable options should there be insufficient land at Jurong East. Mr Tan added that the rental value of commercial properties in Jurong East will likely rise as the majority of HSR commuters will be business travellers.

However, Mr Nicholas Mak, SLP executive director for research and consultancy, felt the areas highlighted by Mr Tan might be ill-suited due to their proximity to Jurong Lake and the density of the area. Mr Mak said to TODAY that the HSR station alone will not contribute to a rise in property prices but rather, the developments built to accompany it that would raise real estate prices as they will contribute to job creation, increased convenience and an improved standard of living. Mr Mak also added that the prized waterfront plots near the proposed location would be better used for recreational or residential purposes.

Most of the residents in the Jurong East area interviewed by TODAY had positive reactions to the news, citing convenience and an increase in leisure options as the main plus points for the decision. Those who visit Malaysia on a regular basis were happy with the potential ease of travel. Travel time to Kuala Lumpur currently takes around three hours by car, but will be reduced with the implementation of the high-speed rail.

However, some residents felt that the area already faces congestion problems due to the shopping malls and the upcoming Ng Teng Fong General Hospital, which could worsen with the increased traffic flow the terminus will create. Another concern brought up by a resident was the rising temperatures. Trees have been removed to make way for developments and the lack of greenery around Jurong East has caused temperatures to climb.

A timeline has yet to be determined for the construction of the terminus, but the completion date will likely be after 2020, noted Prime Minister Lee Hsien Loong. At present, Jurong East is the second biggest commercial hub after the Central Business District (CBD) and could become the next CBD once the terminus is completed.

Pioneer batch of Skyville@Dawson residents collect keys to their units

Keys for the new generation public housing development Skyville@Dawson were distributed to its first batch of residents on 2nd May. The project is due for completion by Q3 2015 and is one of the two projects under the "Remaking Our Heartland" plan. The other project, SkyTerrace@Dawson has been completed. The remaking plan was developed to promote multi-generation and family-friendly living to create a cohesive and vibrant community. Features that support this plan include a combination of studio apartments with four room and five room flats at SkyTerrace, which enables children to remain close to their parents who live in the studio apartment. The new flats in SkyVille have flexible layouts such as large rooms for young couples which can then be partitioned into a number of bedrooms when they have children.

The projects also include greenery in its sky terraces as well as gardens to allow residents close access to nature and a heritage gallery that encompasses the rich history of the Dawson and Queenstown estates. The upcoming estates of Bidadari, Punggol Northshore and Tampines North will see similar concepts and ideas from the Dawson projects implemented.

For more District Guides, you can head over to iProperty.com Singapore.

* Project naming rights and artist's impression are subject to final confirmation

* Project naming rights and artist's impression are subject to final confirmation * Project naming rights and artist's impression are subject to final confirmation.

* Project naming rights and artist's impression are subject to final confirmation.

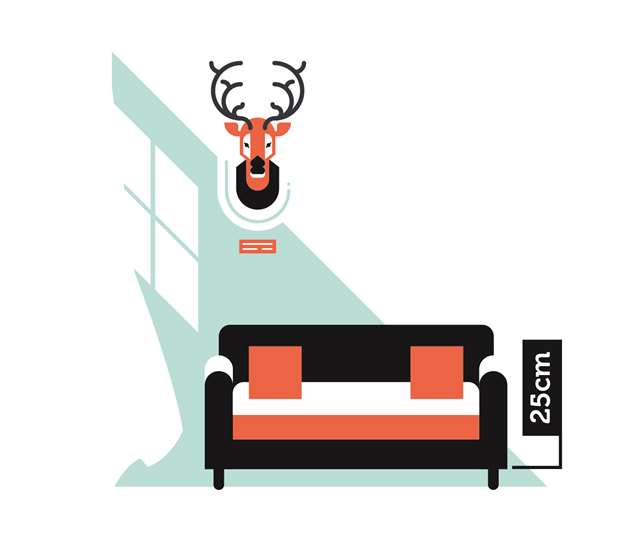

Sofa: 25cm Breathing Space On Each Side When measuring the wall that your sofa will be placed against, ensure that not only is there enough space for your new sofa but also at least 25cm on each side of the couch for breathing space. "If you're planning for your sofa to fit perfectly in that space, your sofa will look and feel crammed and uncomfortable," says Ben Hou, retail manager for furniture retailer OM. Ben also reminds homeowners that the space will also have to accommodate your curtains, which will take up 10-15cm of wall space.

Sofa: 25cm Breathing Space On Each Side When measuring the wall that your sofa will be placed against, ensure that not only is there enough space for your new sofa but also at least 25cm on each side of the couch for breathing space. "If you're planning for your sofa to fit perfectly in that space, your sofa will look and feel crammed and uncomfortable," says Ben Hou, retail manager for furniture retailer OM. Ben also reminds homeowners that the space will also have to accommodate your curtains, which will take up 10-15cm of wall space.  Floor Tiles: That Trendy 80 x 80 To get away from the uniform HDB look, homeowners now go for larger tile sizes than the typically supplied 60 x 60 cm. "People don't like grout lines," says Wee Geck Ying, Senior Business Development Executive for Hafary, a tiles supplier, "and more are opting for 80 x 80 cm tile sizes." If you want even bigger sizes, you need to see if your living space can accommodate them. For example, if you can only lay a handful of 60 x 180 cm tiles in a small space, the room will just look awkward. Also remember that bigger tile sizes not only cost more per sqft, the labour cost to lay each tile is also higher since since two men will be required to lay each tile right.

Floor Tiles: That Trendy 80 x 80 To get away from the uniform HDB look, homeowners now go for larger tile sizes than the typically supplied 60 x 60 cm. "People don't like grout lines," says Wee Geck Ying, Senior Business Development Executive for Hafary, a tiles supplier, "and more are opting for 80 x 80 cm tile sizes." If you want even bigger sizes, you need to see if your living space can accommodate them. For example, if you can only lay a handful of 60 x 180 cm tiles in a small space, the room will just look awkward. Also remember that bigger tile sizes not only cost more per sqft, the labour cost to lay each tile is also higher since since two men will be required to lay each tile right.  Pendant Lamps: 30cm Clearance Space First consider the height of your ceiling when hanging up your lamp and then ensure that there is enough clearance space for the height of the people using that space. You should provide at least 30 cm clearance space for the person standing below. Hanging a pendant lamp too high up may not be aesthetically pleasing too. Plan for the lamp to cover up to 20 per cent of the ceiling height for the space to look balanced. If you have a rectangular table below the lamp, you may wish to install more hanging pendant lamps over the table.

Pendant Lamps: 30cm Clearance Space First consider the height of your ceiling when hanging up your lamp and then ensure that there is enough clearance space for the height of the people using that space. You should provide at least 30 cm clearance space for the person standing below. Hanging a pendant lamp too high up may not be aesthetically pleasing too. Plan for the lamp to cover up to 20 per cent of the ceiling height for the space to look balanced. If you have a rectangular table below the lamp, you may wish to install more hanging pendant lamps over the table.  Coffee Table: Allow For LegroomMake sure there is enough legroom between your coffee table and your sofa when you sit down. Ben reckons 30cm is the bare minimum space you should allow for. On the other side of the coffee table, you should allow for at least 40-45 cm between the table and the TV console so that you'll be able to pull open your coffee table or console drawers.

Coffee Table: Allow For LegroomMake sure there is enough legroom between your coffee table and your sofa when you sit down. Ben reckons 30cm is the bare minimum space you should allow for. On the other side of the coffee table, you should allow for at least 40-45 cm between the table and the TV console so that you'll be able to pull open your coffee table or console drawers. Sinks & Faucets: The Perfect Permutation Consider the usage of your wash area before selecting your faucet and sink. For example, will you be using the area to brush your teeth or to fill a large pot of water? For the former, you'll prefer a lower faucet spout to bathroom sink height so that it will create less splash, i.e. a lower faucet height in a deeper basin. For the latter, you'll prefer a higher faucet height coupled with an undermount basin for a larger range of motions without bumping into the handles. If you have an overhanging cabinet with a standard bathroom countertop height of about 80cm, you'll have a smaller range of faucets to select from.

Sinks & Faucets: The Perfect Permutation Consider the usage of your wash area before selecting your faucet and sink. For example, will you be using the area to brush your teeth or to fill a large pot of water? For the former, you'll prefer a lower faucet spout to bathroom sink height so that it will create less splash, i.e. a lower faucet height in a deeper basin. For the latter, you'll prefer a higher faucet height coupled with an undermount basin for a larger range of motions without bumping into the handles. If you have an overhanging cabinet with a standard bathroom countertop height of about 80cm, you'll have a smaller range of faucets to select from.  Bathroom Floor Tiles: 30 x 30 Is Safer Grout lines are your friends when it comes to the bathroom, as they will help to make your floor slip resistant. Therefore large tile sizes should be avoided. Also note that any type of flooring is going to be slippery when it comes into contact with water. Eschewing the typical HDB supplied 30 x 30 cm bathroom tiles, you can opt for sizes of up to the 30 x 60 cm varieties. Anything bigger is not recommended. Smaller tile sizes will also make it easier for your contractor to level a slope to the floor drain.

Bathroom Floor Tiles: 30 x 30 Is Safer Grout lines are your friends when it comes to the bathroom, as they will help to make your floor slip resistant. Therefore large tile sizes should be avoided. Also note that any type of flooring is going to be slippery when it comes into contact with water. Eschewing the typical HDB supplied 30 x 30 cm bathroom tiles, you can opt for sizes of up to the 30 x 60 cm varieties. Anything bigger is not recommended. Smaller tile sizes will also make it easier for your contractor to level a slope to the floor drain.