We speak to Knight Frank about the emergence of Victoria, London as a prime destination, as well as other hotspots and the key factors drawing global investors to them.

Traditionally seen as a transport hub for commuters and office workers, Victoria is now re-emerging as a destination in its own right. Its central London location and excellent connectivity continues to drive interest in the area, and over three million square feet of new offices, retail and residential space has been unlocked for investment and redevelopment.

![]()

Despite its position in Westminster, one of London's most vibrant boroughs, average values in Victoria remain significantly lower than the surrounding prime neighbourhoods, such as Belgravia and Knightsbridge.

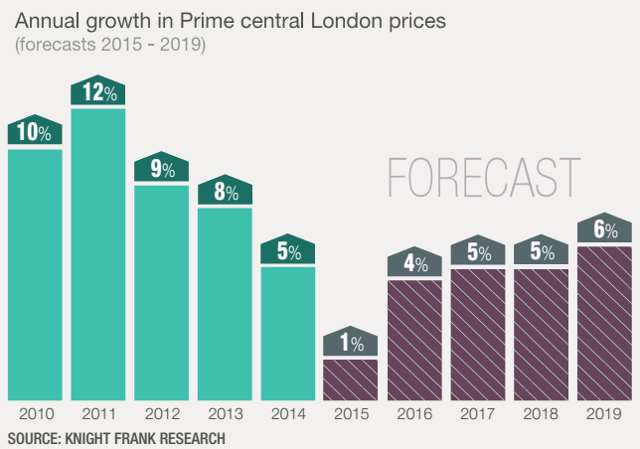

According to Knight Frank research, over the last 12 months, Victoria has seen the biggest increase in the number of £1m+ sales compared to any other area of London. This compelling statistic helps to position Victoria firmly as one of the capital's prime residential districts. Combined with this, the current regeneration of the area suggests that positive growth will be continued.

Driving this regeneration are a number of new prime residential developments, such as Land Securities' Nova and King's Gate, which will not only transform Victoria in to a vibrant new neighbourhood, but also provide the catalyst for improved retail and leisure facilities.

Historically, research demonstrates that residential prices benefit from improved transport infrastructure, with proximity to transport hubs being one of the most important factors for buyers and tenants when choosing a new home. Average prices, within a 1km radius of Victoria station, have outperformed those in prime central London, as well as Greater London, since 2000. Work has already started on the upgrade of Victoria station, ensuring that the area remains one of London's best connected boroughs.

![]()

Richard Klein, Partner at Knight Frank, comments: "Victoria has often been seen as an area of central London to pass through rather than a place to spend time in. The transformation driven by Land Securities has significantly improved the office, retail and residential offer and with the wealth of new restaurants confirmed at Nova, Victoria will soon become a stand out food quarter within London. The area has always had an enviable location, with excellent transport links and proximity to royal parks and iconic landmarks, including Buckingham Palace. Yet, Victoria still offers far greater value than the adjoining areas of Belgravia and Mayfair. The vast improvements to the entire estate will make it an attractive destination for investors looking for capital appreciation but also owner occupiers wishing to make Victoria their home."

So apart from Victoria in London, which are some of the other potential property investment destinations and what are some of the current trends for Singapore-based investors?

We speak to Mr Liam Bailey, Global Head of Research, Knight Frank, Mr Tim Hyatt, Head of Residential Lettings, London, Knight Frank and Mr Kah-Poh Tay, Executive Director, Residential Services, Knight Frank Singapore to find out more.

![]()

Where investors should be looking for potential property investment? Should investors be looking at emerging markets such as Cambodia and Vietnam etc? or undervalued areas around traditional prime cities or hubs such as Victoria in London or Brooklyn in New York?

Liam: Both are valid strategies - both share a desire to diversify away from purely prime safe haven assets. Most investors are currently looking at trying to outperform prime market averages after a period of strong growth

What are some of the key factors that are drawing in investors? Is it advantageous currency exchange and regulations for foreign investors, stability and forecasted growth of economy coupled with demand of homes, or based on trends and cycles, rental income and capital growth?

Liam: Currency is an aid to demand - but ultimately the investment rationale has to stack up - so the underlying economic and employment environment has to be positiveTim: Areas like Victoria in Prime Central London where the key drivers for rental investments are there in abundance, namely good transport links and high end retail emerging.

For Singapore-based investors, are they still investing in London properties?

Focussing on Prime Central London, comparing the sales in 2010 and 2015:1. In 2010, Singapore made up 7% of all the buyers in Prime Central London2. In 2015, Singapore made up 2.1% of all the buyers in Prime Central London

Number of Singapore buyers in London has been on the decline. Why do you think that is so?

Liam: Cooling measures in Singapore, specifically debt servicing rules have weighed on demand

Do you expect Singapore investors to remain interested in the London residential market, and why?

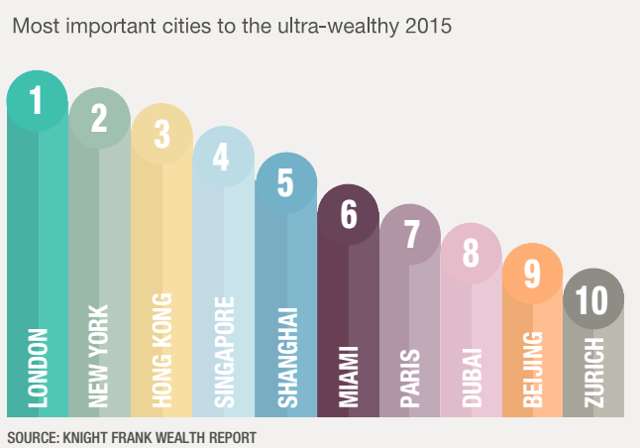

Tim: Yes. London remains one, if not the leading Capital Cities in the world. With tenant demand at nearly 30% and rising, generating a yield and strong total returns remains highly achievable.

Apart from Malaysia and UK, Australia remains a favourite hotspot of Singapore buyers? Why do you think that is so, and how does London compare with Australia, in terms for Singapore buyers?

Kah-Poh: Australia - there are ties of kinship (migration) and education that make Australia (especially Sydney, Brisbane, Melbourne & Perth) attractive to Singapore buyers. In recent times, the AUD has depreciated against SGD and that doubles the attraction. Both London & Australia have their positives for Singapore investors, but London has better long-term growth prospects against Australian cities on account of its history, market depth and importance as a hub for global finance.

Where else are Singapore investors buying now?

Kah-Poh: Singaporeans are quite adventurous and have sampled Japan, Cambodia, Myanmar and other unconventional markets but these tend to be more risky compared to the core markets. The key is to do proper due diligence.

For more District Guides, you can head over to iProperty.com Singapore.

Traditionally seen as a transport hub for commuters and office workers, Victoria is now re-emerging as a destination in its own right. Its central London location and excellent connectivity continues to drive interest in the area, and over three million square feet of new offices, retail and residential space has been unlocked for investment and redevelopment.

Despite its position in Westminster, one of London's most vibrant boroughs, average values in Victoria remain significantly lower than the surrounding prime neighbourhoods, such as Belgravia and Knightsbridge.

According to Knight Frank research, over the last 12 months, Victoria has seen the biggest increase in the number of £1m+ sales compared to any other area of London. This compelling statistic helps to position Victoria firmly as one of the capital's prime residential districts. Combined with this, the current regeneration of the area suggests that positive growth will be continued.

Driving this regeneration are a number of new prime residential developments, such as Land Securities' Nova and King's Gate, which will not only transform Victoria in to a vibrant new neighbourhood, but also provide the catalyst for improved retail and leisure facilities.

Historically, research demonstrates that residential prices benefit from improved transport infrastructure, with proximity to transport hubs being one of the most important factors for buyers and tenants when choosing a new home. Average prices, within a 1km radius of Victoria station, have outperformed those in prime central London, as well as Greater London, since 2000. Work has already started on the upgrade of Victoria station, ensuring that the area remains one of London's best connected boroughs.

Richard Klein, Partner at Knight Frank, comments: "Victoria has often been seen as an area of central London to pass through rather than a place to spend time in. The transformation driven by Land Securities has significantly improved the office, retail and residential offer and with the wealth of new restaurants confirmed at Nova, Victoria will soon become a stand out food quarter within London. The area has always had an enviable location, with excellent transport links and proximity to royal parks and iconic landmarks, including Buckingham Palace. Yet, Victoria still offers far greater value than the adjoining areas of Belgravia and Mayfair. The vast improvements to the entire estate will make it an attractive destination for investors looking for capital appreciation but also owner occupiers wishing to make Victoria their home."

So apart from Victoria in London, which are some of the other potential property investment destinations and what are some of the current trends for Singapore-based investors?

We speak to Mr Liam Bailey, Global Head of Research, Knight Frank, Mr Tim Hyatt, Head of Residential Lettings, London, Knight Frank and Mr Kah-Poh Tay, Executive Director, Residential Services, Knight Frank Singapore to find out more.

Where investors should be looking for potential property investment? Should investors be looking at emerging markets such as Cambodia and Vietnam etc? or undervalued areas around traditional prime cities or hubs such as Victoria in London or Brooklyn in New York?

Liam: Both are valid strategies - both share a desire to diversify away from purely prime safe haven assets. Most investors are currently looking at trying to outperform prime market averages after a period of strong growth

What are some of the key factors that are drawing in investors? Is it advantageous currency exchange and regulations for foreign investors, stability and forecasted growth of economy coupled with demand of homes, or based on trends and cycles, rental income and capital growth?

Liam: Currency is an aid to demand - but ultimately the investment rationale has to stack up - so the underlying economic and employment environment has to be positiveTim: Areas like Victoria in Prime Central London where the key drivers for rental investments are there in abundance, namely good transport links and high end retail emerging.

For Singapore-based investors, are they still investing in London properties?

Focussing on Prime Central London, comparing the sales in 2010 and 2015:1. In 2010, Singapore made up 7% of all the buyers in Prime Central London2. In 2015, Singapore made up 2.1% of all the buyers in Prime Central London

Number of Singapore buyers in London has been on the decline. Why do you think that is so?

Liam: Cooling measures in Singapore, specifically debt servicing rules have weighed on demand

Do you expect Singapore investors to remain interested in the London residential market, and why?

Tim: Yes. London remains one, if not the leading Capital Cities in the world. With tenant demand at nearly 30% and rising, generating a yield and strong total returns remains highly achievable.

Apart from Malaysia and UK, Australia remains a favourite hotspot of Singapore buyers? Why do you think that is so, and how does London compare with Australia, in terms for Singapore buyers?

Kah-Poh: Australia - there are ties of kinship (migration) and education that make Australia (especially Sydney, Brisbane, Melbourne & Perth) attractive to Singapore buyers. In recent times, the AUD has depreciated against SGD and that doubles the attraction. Both London & Australia have their positives for Singapore investors, but London has better long-term growth prospects against Australian cities on account of its history, market depth and importance as a hub for global finance.

Where else are Singapore investors buying now?

Kah-Poh: Singaporeans are quite adventurous and have sampled Japan, Cambodia, Myanmar and other unconventional markets but these tend to be more risky compared to the core markets. The key is to do proper due diligence.

For more District Guides, you can head over to iProperty.com Singapore.